In May, I was honored to give a Win/Loss analysis webinar, as part of the competitive intelligence #IntelCollab series facilitated by Craig Fleisher, Chief Learning Officer at Aurora WDC.

View the Win/Loss slides: The What, Why and How of Win/Loss Analysis. Check out the book, Win/Loss Analysis: How to Capture and Keep the Business You Want.

Since people often disconnect for Q&A, I am including them in this blog.

What internal group supports Win/Loss programs in your experience? If it’s not competitive intelligence (CI), as not all companies have a CI person or team, it’s usually a manager or executive in business development or marketing.

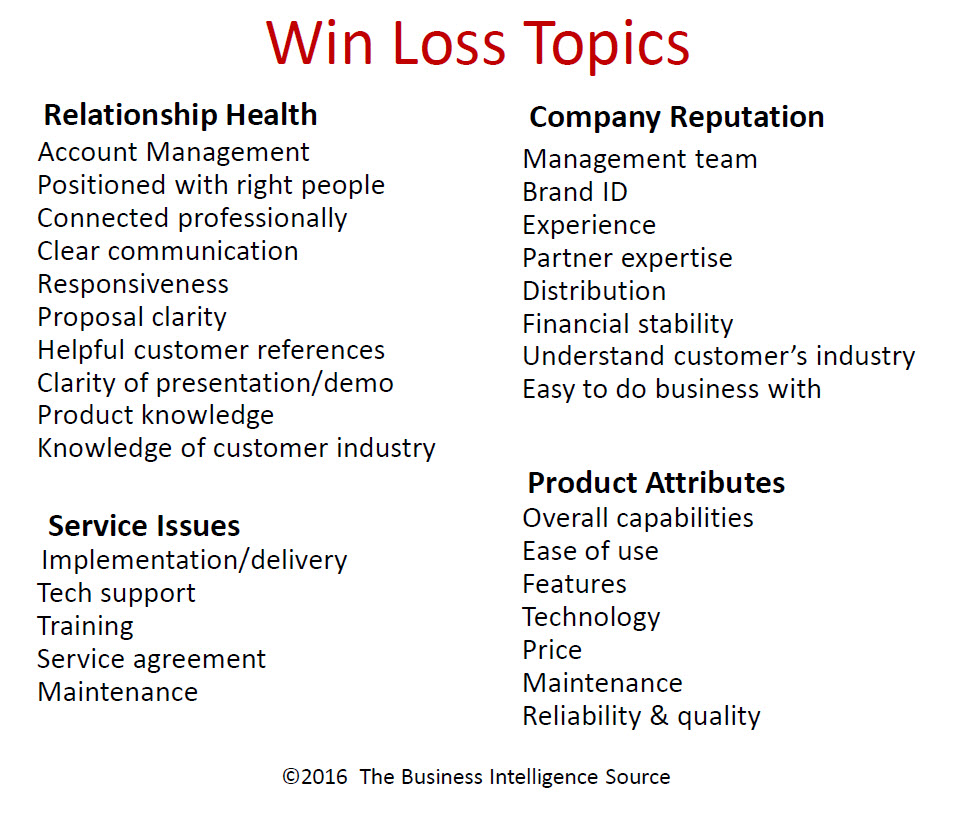

What are some of the best practices to break through internal company resistance to Win/Loss analysis? First, only one part of Win/Loss analysis targets sales performance and professionalism as you’ll see in the Win/Loss topics chart below.

Other areas include product attributes, service issues and company reputation. Sales also is motivated to cooperate from this Win/Loss statistic: taking action from a formal Win/Loss program can improve win rates from 15 – 30%. On the other hand, know that Win/Loss isn’t for every company. As mentioned in the webinar, some companies have never heard of Win/Loss. Some think they’re doing it when they’re not. Others are going through the steps of Win/Loss, but aren’t making any changes from the results. Some are stymied by politics and/or arrogance to seriously consider a Win/Loss program.

When is the best time after the buying decision to conduct Win/Loss analysis interviews? Ideally it’s 2 to 3 months after the buying decision has been made, and people know you aren’t selling to them. If you wait too long, people forget the details of their buying decision, and sometimes they move onto another position within the company or leave the company. Sometimes I have great interviews when the decision-maker has left the company and I listen to the person who has been forced to adopt the solution or product. While I don’t learn about the decision-making process, I do find out how well the product is working, often in much more detail than I would have from the decision-maker.

Due to the sensitivity of Win/Loss analysis, is it better to hire a third party? First of all: if you conduct the interviews in-house, don’t have sales people do them. Customers don’t want to deliver bad news to sales people: it’s just human nature. You want to hear everything. Although it’s great to have sales people pave the way for whoever is conducting the Win/Loss interviews. In more complex deals, sales people might even be present for the Win/Loss interviews, but I would have someone else be the key interviewer. Marketing or Product Developers can conduct these interviews since they often have the product knowledge and the bigger picture of where your company wants to go. However, many of them are not expert interviewers, as this is just a small part of their job responsibilities.

Third parties are often preferred for two reasons: they are a neutral source so customers and those who chose a competitor feel more free to share; Win/Loss consultants are expert interviewers since this tends to be their full-time job. Their focus is customer intelligence. Don’t ask me why, but I find that when I conduct Win/Loss interviews, people are happy to share the good, the bad and the ugly with me, even though they know that my client is the recipient of all this information (although I do not disclose the names of the individuals interviewed).

I will include the next 5 questions in a future blog or on my LinkedIn blog.

To learn more about how to conduct your company’s Win Loss analysis, check out my book: Win/Loss Analysis: How to Capture and Keep the Business You Want.

Reblogged this on Gr8fullsoul.